Thanks to Prop 19, homeowners aged 55+, people with severe disabilities and victims of natural disasters can move closer to family, medical care, or to a home that better meets their needs anywhere in California without a tax penalty. Prop 19 also removed unfair restrictions on Californians with severe disabilities, allowing homeowners to move to a replacement home anywhere in California without a tax penalty.*

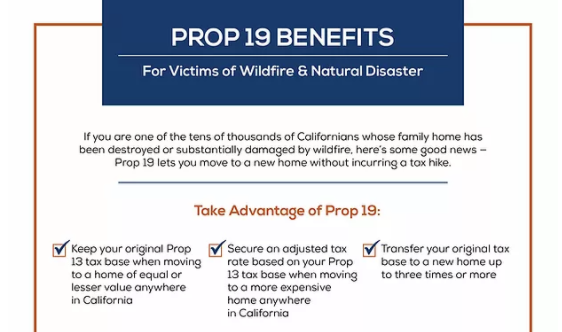

And after wildfires destroyed more than 24,000 family homes in the past few years, wildfire victims have faced massive property tax hikes when relocating to another home. Prop 19 allows victims of wildfires or natural disasters to transfer the property tax base of their damaged house to a replacement home anywhere in California.*

*Purchasing a more expensive home will result in an adjusted tax increase based on the original property’s Prop 13 tax basis.

The video below concisely explains Prop 19 and the opportunities available to your eligible clients. Click to watch and share with your network!

And don’t forget to visit the dedicated website for all the resources you and your clients need on Prop 19, including these marketing materials on eligibility:

And don’t forget to visit the dedicated website for all the resources you and your clients need on Prop 19, including these marketing materials on eligibility:

|

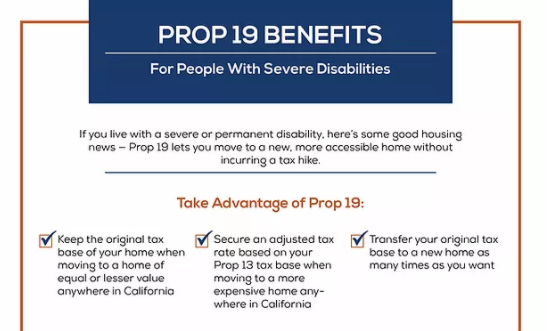

People With Severe Disabilities If your client lives with a severe or permanent disability, you can help them move to a new, more accessible home without incurring a tax hike.* Download here. |

|

Victims of Wildfire and Natural Disasters If your client is one of the tens of thousands of Californians whose family home has been destroyed or substantially damaged by wildfire, Prop 19 lets them move to a new home without incurring a tax hike.* Download here. |

|

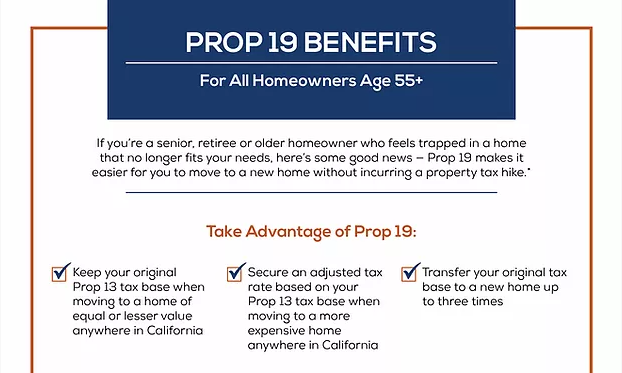

Homeowners Age 55+ If your client is a senior, retiree or older homeowner who feels trapped in a home that no longer fits their needs, you can help them move to a new home without incurring an increase in property tax.* Download here. |